Sept. 13, 2023

COHHIO’s Executive Director Amy Riegel encouraged the Senate Select Committee on Housing to build on successful initiatives that help struggling Ohioans stay housed, like the Ohio Housing Trust Fund and the Low Income Housing Tax Credit program.

“In the same way Ohio fosters a welcoming climate for business and investment, we can tackle the affordable housing crisis by cultivating a more positive approach to housing that supports safe, decent affordable housing for all as a foundation for homeownership. We can do that by examining programs that are working and scale them appropriately to meet demand,” she said. “The housing affordability crisis is real, but Ohio already has many effective programs that only need to be brought to scale.”

Ohio Senate President Matt Huffman (R-Lima) recently created the new housing committee “to learn what additional steps the state can take to encourage homeownership while removing barriers that entrepreneurs encounter as they work to revitalize our neighborhoods.”

Riegel urged the committee to consider the housing affordability crisis holistically and noted that the housing market and rental markets are connected. (Committee Video)

“As rents spiked and mortgage interest rates climbed in recent years, aspiring first-time homebuyers are having trouble saving up for a down payment. That means many would-be homeowners remain renters for longer periods of time, increasing the demand for rental housing, which drives the cost of rent higher, putting homeownership further out of reach,” she said. “These would-be homeowners are also competing with lower income renters for a dwindling supply of rental units with rapidly escalating rents. The brunt of the crisis is being inflicted on Ohioans who are working high-demand, low-wage jobs, often pushing them into eviction and, in the worst-case scenarios, homelessness.”

Testimony before the Senate Select Committee on Housing

Amy Riegel, COHHIO Executive Director

Sept. 13, 2023

Chair Reynolds, Vice Chair Johnson, Ranking Member Craig, and members of the Senate Select Committee on Housing, thank you for the opportunity to provide testimony that may be helpful as you investigate potential solutions to Ohio’s housing affordability crisis. My name is Amy Riegel, executive director of COHHIO. We are a coalition of organizations and individuals committed to ending homelessness and to promoting decent, safe, fair, affordable housing for all, with a focus on assisting low-income and special needs populations. In short, we represent real people who live in affordable housing or are experiencing homelessness.

In late 2020, we started seeing an alarming spike in housing costs, both in the real estate and the rental housing market. After a decade of increasing, Ohio’s homeownership rate fell from a high of 70% in 2020 to 64% two years later. That marks the first time on record that Ohio’s homeownership rate was lower than the national average of 66%.

At the same time, average rent for a two-bedroom apartment in Ohio increased by 24% between August 2020 and August 2022, according to Apartment List rent estimates. The Ohio Housing Finance Agency’s recent Housing Needs Assessment found Ohio rents are now higher than in any year on record other than 2021, even when adjusted for inflation.

As rents spiked and mortgage interest rates climbed in recent years, aspiring first-time homebuyers are having trouble saving up for a down payment. That means many would-be homeowners remain renters for longer periods of time, increasing the demand for rental housing, which drives the cost of rent higher, putting homeownership further out of reach. These would-be homeowners are also competing with lower income renters for a dwindling supply of rental units with rapidly escalating rents. The brunt of the crisis is being inflicted on Ohioans who are working high-demand, low-wage jobs, often pushing them into eviction and, in the worst-case scenarios, homelessness.

Housing costs have grown much faster than income, especially for those in the lower income brackets. Renters need to earn at least $19.09/hour to afford a basic 2BR apartment in Ohio. But only three of the 10 most common jobs actually pay that much. This has created a situation where today nearly 708,000 Ohio renters are spending over half their income on rent.

This leaves little room for error. A car accident, a sick child, or a broken leg can mean missed work hours that a family needs to pay the rent. Eviction filings dropped dramatically at the beginning of the pandemic, but have since returned to pre-pandemic levels. And communities around the state are reporting troubling increases in unsheltered homelessness.

Any effort to expand access to homeownership must also address problems in the rental market because the two are connected in a delicate ecosystem, where disturbances to one part of the housing continuum is felt throughout.

If we want families to flourish, we need to ensure everyone has access to safe, decent, affordable housing. We must create an environment that allows anyone to fulfill the dream of homeownership. Seen through this lens, Ohio’s population consists of future homeowners, people who are ready for homeownership now, and current homeowners. The following recommendations are designed to support Ohioans in all three categories.

- Future homeowners:

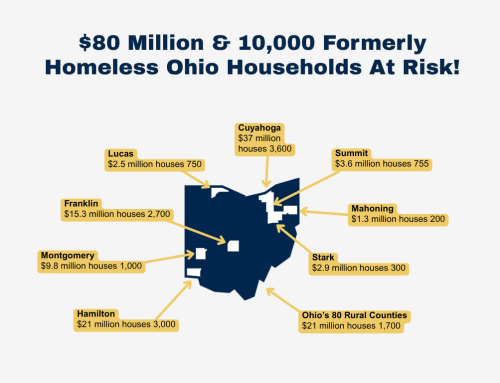

If you start with the premise that everyone should have access to safe, decent, affordable housing, it opens the possibility for everyone to pursue the dream of homeownership. Ohio has a shortage of about 270,000 rental units that are affordable and available to the 448,000 extremely low-income households in Ohio, and that gap increased by 6% in just the past year. There are many programs throughout the state that are working to reduce the gap, and they are making a positive impact, but the current resources are dwarfed by the problem. Any approach to addressing housing affordability should start by building on demonstrated success.

- Supply-side Tax Credit Programs – The new State Housing Tax Credit Program included in the biennial budget was a great first step to expanding access to affordable rental housing. This tax credit will augment the federal Low Income Housing Tax Credit (LIHTC), which was created during the Reagan Administration to incentivize private investment needed to fill the gap between the cost of constructing rental housing and the rents lower income residents can afford. LIHTC is now the primary source of affordable housing development in the nation. By incentivizing private investment, the federal LIHTC program has financed over 146,000 affordable rental units in Ohio. These homes come in many different shapes and sizes and fulfill a critical need for workforce housing in communities throughout Ohio. OHFA is diligently working to roll out the new state program. Upon its demonstrated success, we hope this committee will recommend that we fully utilize the assets available to the state of Ohio to authorize additional funding.

- Ohio Housing Trust Fund – Funded by a fee that mirrors county recording fees, the OHTF is the most impactful source of state funding for a variety of local housing programs. Most OHTF funding is allocated for three main categories: housing development and rehab; home repair programs, and homeless services. Last year the OHTF supported homeless services for over 42,000 Ohioans; funded the repair of 21,600 homes, and helped finance the construction and rehabilitation of nearly 300 units of affordable rental units. For example, the OHTF provided nearly $500,000 to the Lancaster-Fairfield Community Action Partnership to repair homes for low-income resident during 2019 to 2021. Hocking Athens Perry Community Action Agency received $156,000 to provide emergency home repair and handicapped accessibility modifications for homeowners who are at or below 50% of Area Median Income. The Salvation Army in Newark was awarded $307,000 in 2021 to operate a 50-bed emergency shelter serving homeless adults and households with children. (OHTF Award Map) The biennial budget increased the OHTF’s annual allocation cap to $65 million annually, which is fantastic. However, this committee should consider adjusting recording fees to compensate for inflation and declining real estate activity that will negatively impact future revenues.

We also see opportunities to develop new policies and programs that will help to foster a positive housing market in Ohio.

- Eviction Sealing Legislation –Evictions inflict long-term damage on evicted tenants: they lose their possessions, important records; children often have to switch schools, live in unstable conditions; families double up in overcrowded conditions; and parents often lose their jobs. During a normal year, Ohio landlords file about 105,000 eviction cases, but that dropped precipitously during the beginning of the pandemic. However, in many areas of Ohio, evictions have returned to record high pre-pandemic levels. In the last meeting, you heard about the well-reported eviction filings in Central Ohio, but we are also seeing dramatic increases in southwest Ohio. Butler County had the highest rate of eviction filings, which experienced a 25% increase since last year. Montgomery County saw a 41% increase, Warren County 27%; Clark County 25%; Greene County 13%; Miami County 9%; and Champaign County 5%, according to Ohio Supreme Court data. Ohio is one of only five states in the nation with no cure for nonpayment of rent, allowing for eviction of tenants at will for no fault of their own. Eviction filings remain on tenants’ records, making it much more difficult to find housing in the future. Legislation allowing tenants to request sealing of past evictions will make help create more housing access for struggling renters.

- Landlord Credit Score Cost Assistance – 60 million American are “unbanked” and 45 million are credit invisible, according to the Governor’s Office. This creates a nearly insurmountable barrier for would-be homebuyers shopping for an affordable mortgage. Gov. DeWine’s executive budget included a $1.5 million/year appropriation to cover landlords’ costs to report rent payments to credit bureaus. The committee should revisit this innovative plan to help tenants build positive credit scores needed for homeownership.

- People who are ready to become homeowners

Rapidly rising interest rates, dwindling inventory, and sky-high home prices are making the cost of homeownership prohibitively expensive for first-time homebuyers. Adding to these pressures are outdated zoning ordinances that limit the ability to create enough housing to meet demand, and institutional investors, who are buying up starter homes by the dozen and converting them to rentals with monthly rents that are 32% higher than a monthly mortgage payment would cost to own the same home. The state can expand options for would-be homebuyers by fostering a broader, more innovative and inclusive approach to development, while keeping Wall Street from profiteering off of Ohio’s communities.

- Zoning reform – many communities are saddled with decades-old zoning laws that prevent construction of housing that is affordable to most first-time homebuyers. Mother-in-law suites that were once a mainstay for working families are illegal in most jurisdiction. Many smaller communities lack the capacity to tackle a zoning code update that requires intensive staff time and public input. But they should be able to create a code that reflects the values and integrity of their community while still looking to a future of growth and opportunity. This committee should reconsider the executive budget proposal to invest $1.5 million for grants to help local governments update their zoning codes.

- Institutional investors – For the last 5-10 years, large, out of state, institutional investors, often backed by private equity firms and Wall Street, have been pillaging our communities, stealing homeownership opportunities from Ohioans. For an example, Huber Heights is a small city north of Dayton with just over 17,000 housing units, 74% which are owner occupied – well above the national or Ohio homeownership rate. The city is known for its brick ranch single family homes – the perfect starter home or home for aging in place. Since 2015, institutional investors have quickly been gobbling up these homes. As of August 2022, 1,295 units could be traced to one or two institutional investor – former owner occupied units that are now rentals. That is 7.5% of the housing stock in the community. We appreciate Sen. Blessing’s efforts to curtail pernicious impact of institutional investors in the housing market. This is an evolving issue that leaders at the local, state and federal level are trying to wrap their arms around. We believe Sen. Blessings bills that would offer tenants the right of first refusal on foreclosed properties (SB 36) and levy taxes on bulk home purchases (SB 76) are a great start.

- People who are current homeowners

The post-pandemic housing market boom dramatically raised property values, which is driving property tax increases around the state. Ohio also has an aging housing stock. Over half of all homes were built prior to 1970 and 1 in 4 were built prior to 1940. Houses must be cared for continuously, otherwise they, like all things become victims of decay and neglect. The homeowners most affected by the rising cost of owning and maintaining a home include seniors and people with disabilities who live on a fixed income and were already struggling to maintain their homes. A leaking roof or broken furnace often makes their homes uninhabitable, leading to premature placement in nursing homes or other state-supported institutions.

- Home Repair – Many local community action agencies, area agencies on aging, and other nonprofits offer home repair assistance to low-income homeowners, but demand greatly outstrips funding. An example of this work is Habitat for Humanity of Southeast Ohio, which serves 8 counties (Athens, Fairfield, Hocking, Perry, Meigs, Morgan, Noble, and Muskingum). This Habitat affiliate completes 25 home repairs every year – the number that they are able to achieve based upon funding. However, they receive 20 requests a day. Home repair can “fly under the radar” compared to new home construction, however, a well-preserved home reduces the need for new constructions. As with so many things in life, an ounce of prevention is worth a pound of cure. The Ohio Department of Development provides significant funding for home repair programs through the federal Community Development Block Program and the Ohio Housing Trust Fund. This committee should consider ways to increase funding for these critical programs that keep vulnerable Ohioans in their own homes.

- Foreclosure Prevention – As with eviction, home foreclosures saw a significant decline in 2020, however, foreclosures are ticking back up to pre-pandemic levels. Life comes with many ups and downs, and helping people who achieved the dream of homeownership to remain in their homes is a vital element to housing stability. To prevent a spike in foreclosures during the pandemic, Ohio was awarded $280 million from the American Rescue Plan Act to fund Save the Dream Ohio, which provides mortgage and utility assistance to homeowners. Administered by the Ohio Housing Finance Agency, this program has helped nearly 29,000 households avoid foreclosure and utility shutoffs, but funds are running out. This funding was an effort to address emergency needs, but it only pressed pause. We are now seeing a resurgence in foreclosures. National data shows that Cleveland and Akron are both in the top 20 of communities with the highest rates of foreclosure. Ohio should look for ways to continue to provide foreclosure prevention assistance.

In the same way Ohio fosters a welcoming climate for business and investment, we can tackle the affordable housing crisis by cultivating a more positive approach to housing that supports safe, decent affordable housing for all as a foundation for homeownership. We can do that by examining programs that are working and scale them appropriately to meet demand.

Supporting Ohioans with lower incomes that make homeownership unrealistic in the near term will help position them to participate in the American Dream in future years. Investing resources to ensure safe, decent, affordable housing for all Ohioans will yield positive benefits for the state in other policy areas. Addressing housing insecurity has been shown to reduce public expenditures in hospitals, schools, child welfare, courts, jails, and economic development.

The housing affordability crisis is real, but Ohio already has many effective programs that only need to be brought to scale. The fact that we’re all here today in this committee discussing this issue shows there’s a vested interest among state leaders to find solutions. We look forward to working together with you to develop policies that will expand access to a home for all Ohioans.