FOR IMMEDIATE RELEASE: March 14, 2024

CONTACT: Marcus Roth, marcusroth@cohhio.org

Report: Ohio’s Affordable Housing Gap Shrinks Slightly

Steep rent inflation exacerbated Ohio’s affordable housing crisis in recent years, but a report released Thursday shows modest improvement in the shortage of affordable rental units available to the lowest income Ohioans over the past year.

The Gap Report, released jointly by the National Low Income Housing Coalition (NLIHC) and the Coalition on Homelessness and Housing in Ohio (COHHIO), reveals a deficit of 267,382 rental units that are affordable and available to the 444,768 extremely low-income households in Ohio.

Last year’s Gap Report found a shortage of 270,399 affordable units available to the lowest-income Ohioans, which was 6 percent worse than the year before. The overall ratio of 40 affordable units available to every 100 households remained unchanged from the 2023 to 2024 reports.

Ohio’s largest cities all had similar affordable housing shortages: Cincinnati had a deficit of 49,510 units, Cleveland 56,560 units, and Columbus 52,694 units. However the ratio of affordable units available to extremely low income renters was only 26 to 100 in Columbus, far worse than 41 units to 100 renters in Cincinnati and 38 to 100 in Cleveland.

COHHIO Executive Director Amy Riegel said the two percent decrease in Ohio’s affordable housing shortage is helping the state rebound from a 6 percent increase the previous year, but we are still in recovery mode after unprecedented rent increases.

“It’s great to see that access to affordable housing finally started moving in the right direction. Policymakers took initial steps toward expanding the supply of housing in Ohio, so we’re hopeful we can continue this positive momentum,” she said.

Ohio can address the affordable housing shortage by focusing state and federal resources on those who face the widest gap between rent and income, Riegel said.

“This is no time to rest on our laurels. Evictions and homelessness are still increasing in Ohio. To reverse these troubling trends, we need Congress and the Statehouse to be more assertive in addressing affordability for our most vulnerable residents,” she said.

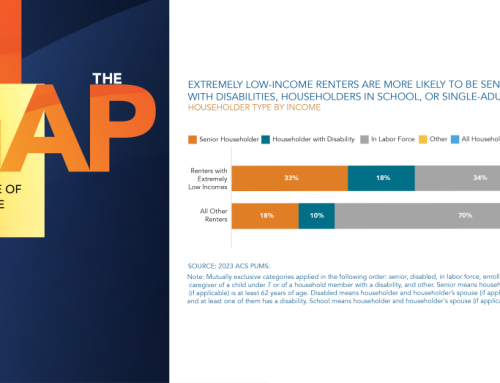

The report found that most rental markets have an adequate supply of housing for middle-income renters, but no market in the U.S. has enough homes for extremely low-income renters. Only 2 percent of Ohio’s middle-income renters spend over half their income on rent while 70 percent of the lowest income renters are considered “severely housing cost burdened” – the highest percentage since 2016.

Riegel said the new State Low income Housing Tax Credit was a great start, but pointed to the need to ensure the program can create rental units that are affordable to extremely low income families. Expanding the Ohio Housing Trust Fund would provide additional gap funding to make those units more affordable.

NLIHC President and CEO Diane Yentel called for significantly increasing federal investments to preserve and expand the supply of deeply affordable units, expanding the Housing Choice Voucher program, and passing the “Eviction Crisis Act,” to establish a housing stabilization fund for renters facing temporary financial setbacks.

“We know what works to end housing insecurity and homelessness – what we lack is the political will to invest in these solutions at the scale needed,” Yentel said. “More than ever, Congress should act quickly to enact bold legislation to ensure rental assistance is universally available, build and preserve homes affordable to people with the lowest incomes, create tools to prevent eviction and homelessness, and strengthen renter protections to keep renters stably housed.”

-30-