Civil rights and housing advocates warned Thursday that the Trump administration’s proposed bank rules would reduce critical investment in low-income communities throughout Ohio.

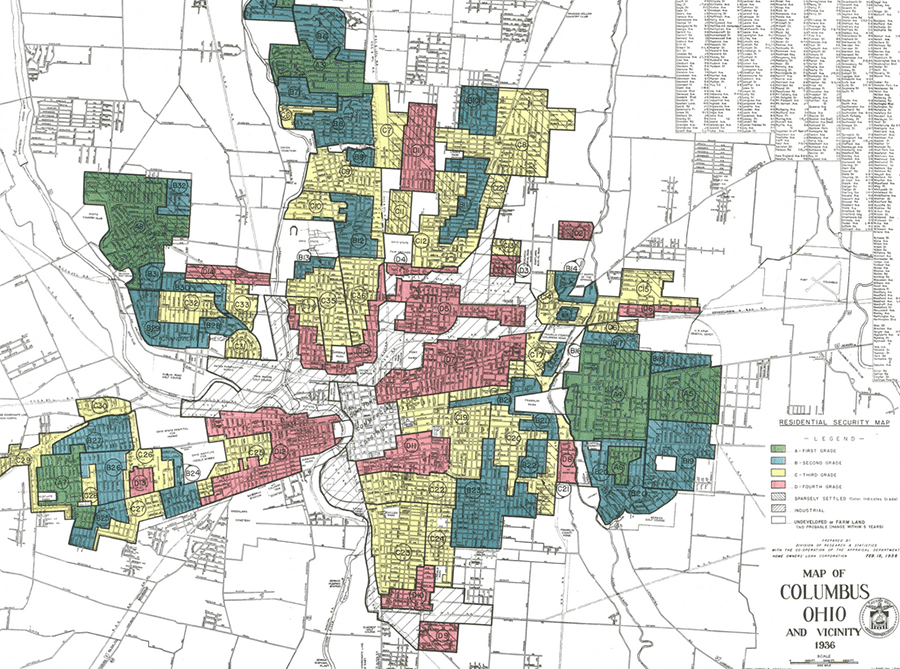

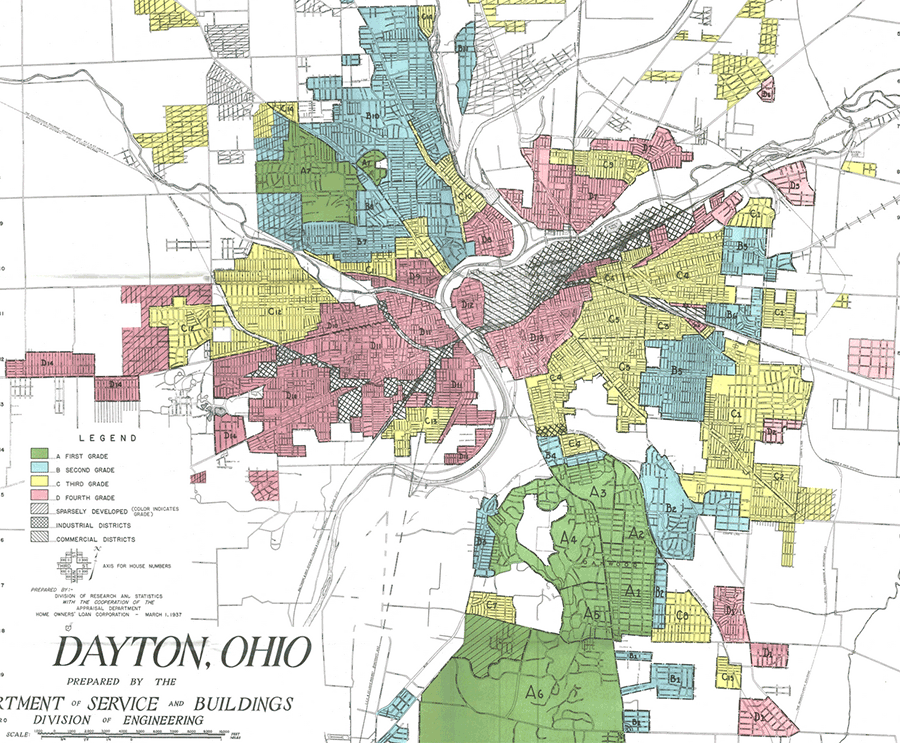

Tom Roberts, president of the Ohio Conference of Units of the NAACP, said the proposal to weaken Community Reinvestment Act rules marks a return to the days when banks were allowed to discriminate against communities of color.

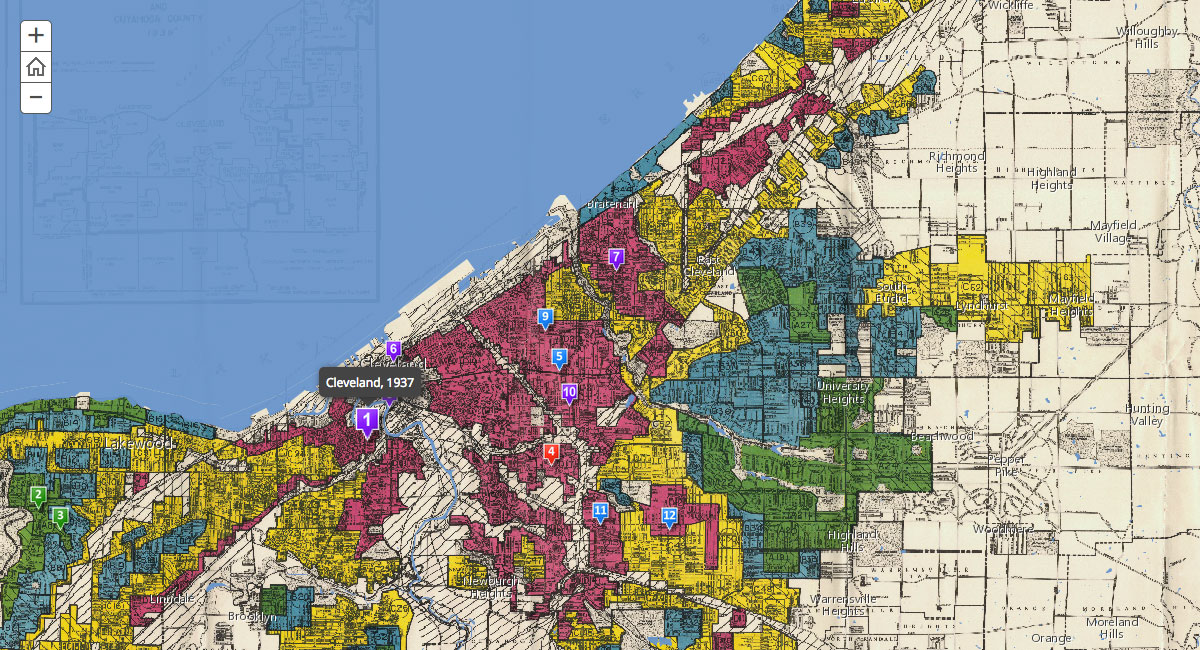

“Redlining is a civil right issue. We are still working to overcome this legacy of discriminatory lending that prevented African-Americans from accessing the capital they needed to take part in the American Dream of homeownership and entrepreneurship,” Roberts said. “We should be talking about strengthening the Community Reinvestment Act, not weakening it.”

Congress passed the Community Reinvestment Act (CRA) in 1977 in order to combat discriminatory lending practices that made it very difficult for African-Americans to purchase a home and start a business. While the impact of historic disinvestment still lingers, the CRA requires banks to serve all the communities – urban, suburban, and rural – that lie within their service area.

“The CRA has helped drive billions of dollars of private investment into things like affordable housing development in neighborhoods where rents have been increasing much faster than incomes for a long time,” said Bill Faith, executive director of the Coalition on Homelessness and Housing in Ohio. “These rules would reduce private investment in affordable housing at a time when we desperately need more of it, not less.”

The rule changes proposed by the U.S. Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) would allow banks to ignore up to half of their service areas. The proposal would also incentivize a few large deals instead of the many home and small business loans that banks currently offer throughout low- and moderate-income neighborhoods.

“If these rules are allowed to take effect, banks would get credit for investing in big flashy projects like stadiums instead of mortgages for working families, and small business loans that allow communities to thrive,” said Nate Coffman, executive director of the Ohio CDC Association. “We’ll see banks invest in gentrifying neighborhoods while disinvesting in historically disenfranchised neighborhoods.”

The National Community Reinvestment Coalition estimates that the proposed rules would reduce home and small business lending in Ohio by $975 million over a five-year period.

Weakening the CRA will leave low-income communities with even fewer responsible loan options, pushing borrowers to payday loan operators, auto title lenders, check cashing stores, and loan sharks.

The existing rules are far from onerous – financial institutions pass 98 percent of their CRA exams. Furthermore, there are no financial penalties for those that fail; just some negative PR and additional scrutiny when banks want to merge or acquire another bank.

The OCC and FDIC have failed to demonstrate a legitimate need for their plan to undermine regulations that ensure financial institutions live up to their responsibility to serve the entire community that supports their business.

We can’t allow banks to go back to cherry-picking which neighborhoods they lend in and don’t lend in,” Faith said. “We call on the OCC and the FDIC to scrap these rules and start over, working with low-income communities to strengthen the CRA in a way that carries out the intent of the law – reinvesting in the communities that banks ignored for most of the 20th Century.”

The advocates want bank regulators to modernize CRA regulations so that they apply to all types of lenders – unaffiliated mortgage companies, credit unions, online lenders, and other non-bank lenders. In addition, they are asking for rules that explicitly state that lenders have an obligation to serve all races and ethnicities.

For information on local impact, see the National Community Reinvestment Coalition website.