A plan to ensure that supportive housing can continue helping Ohioans overcome homelessness and behavioral health issues recently got a unanimous thumbs up from the Ohio General Assembly and Gov. Mike DeWine.

Sponsored by Sen. Bob Hackett (R-London) and Sen. Nickie Antonio (D-Lakewood), Senate Bill 57 clarifies that permanent supportive housing (PSH) facilities will remain exempt from local property tax. While PSH properties have always been tax-exempt as non-profit charities, the state Board of Tax Appeals recently overturned precedent, subjecting the programs to new costs that jeopardize their viability.

After unanimous passage in the Ohio House in March, the Senate finalized Senate Bill 57 on April 21, sending it to Gov. DeWine for his signature.

Bill Faith, executive director of the Coalition on Homelessness and Housing in Ohio, thanked state legislators for protecting local programs that play a key role in efforts to house formerly homeless Ohioans with disabilities.

“Overcoming mental illness and addiction is hard for anybody, but it’s practically impossible when you’re living in a homeless camp or under a bridge. Permanent supportive housing provides people a stable place to live with access to services they need to get healthy and put their lives back together,” Faith said. “It’s truly heartwarming to see the entire legislature unite to ensure these critical homeless programs can remain viable and affordable.”

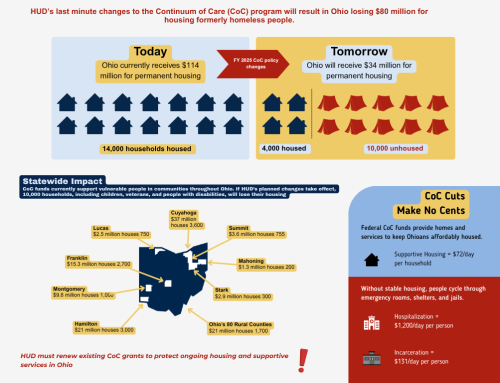

PSH programs combine safe, affordable housing with supportive services to help formerly homeless Ohioans achieve stability while addressing health and wellness issues and increasing their personal and economic independence. Research has shown that PSH reduces utilization of other costly taxpayer-funded crisis services like hospitals, jails, shelters, and psychiatric facilities.

More Information: Ohio Capital Journal article Mar. 30