When it comes to enforcing the Community Reinvestment Act, a federal law that banned discriminatory lending practices in America, the Trump Administration appears to be heading backwards. COHHIO recently submitted a letter to the Office of the Comptroller of the Currency warning that the agency’s new direction for the CRA could seriously diminish banks’ investment in affordable housing.

Thanks to the CRA, banks have issued almost $2 trillion in loans to low- and moderate-income areas since 1996, investments that have helped these communities recover from historic patterns of disinvestment. The OCC’s proposed rules, however, could reduce investment in these communities by up to 20 percent, according to the National Community Reinvestment Coalition. In Ohio that’s $1.9 billion over the next five years.

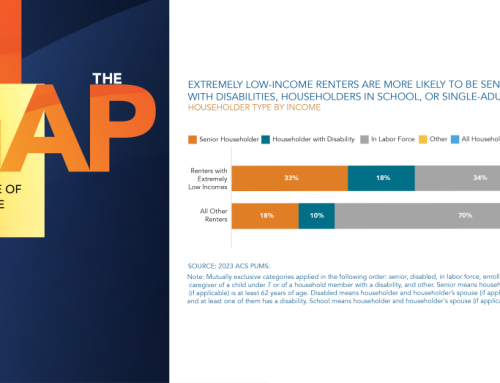

Currently banks are assessed for compliance with the CRA at the local level, but the OCC wants to create a mathematical formula that will simplify the assessment process. Rather than requiring investment in the many local communities where banks have a presence, the “one ratio” proposal would give banks a target amount for their CRA investment. This approach would allow banks to focus on fewer big, high-cost projects in the more expensive housing markets, where it will be much easier to reach their target investment volume. This could fuel gentrification in certain urban neighborhoods, while exacerbating the existing shortage of affordable housing in both urban and rural areas.

Weakening CRA rules would also reduce demand for Low Income Housing Tax Credits, which would have a negative impact on overall affordable housing production in the U.S. Commercial banks, encouraged by the CRA, currently provide over 80% of the equity capital for the LIHTC program.

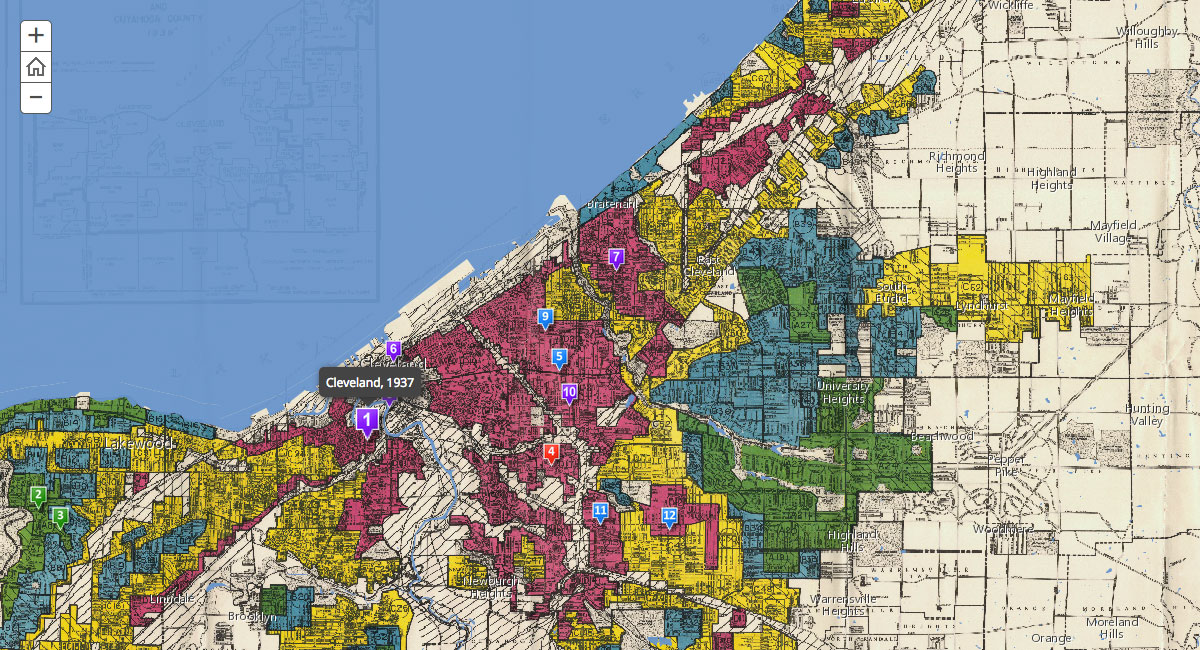

The Community Reinvestment Act was passed in 1977 to end discrimination that was once widespread in America’s banking and housing markets. While the law officially ended the practice of “redlining”, discriminatory lending remains a problem in Ohio:

- Black applicants in Dayton were 2.1 times as likely to be denied a conventional home mortgage as white applicants, even when controlling for income, loan amount and neighborhood.

- Two Cincinnati-based banks, Union Savings Bank and Guardian Savings Bank, reached a settlement in 2016 over allegations of redlining “predominantly African-American” neighborhoods in Cincinnati, Columbus, Dayton, and Indianapolis.

- A recent Ohio Housing Finance Agency study found that Cleveland and Columbus neighborhoods once marked red on redlining maps currently have some of the highest eviction rates.

As these stories show, we’re still dealing with the legacy of redlining. Nonetheless, 98 percent of banks currently pass their CRA exams. If anything, the rules should be strengthened, not watered down.

More Information:

- COHHIO’s letter of opposition to the OCC’s rulemaking

- City Lab: It’s Time to Rewrite Fair Lending Rules (Just Not Like This)

- New York Times: A Green Light for Banks to Start ‘Redlining’ Again

- NCRC CRA Toolkit