This Thanksgiving break will be a much-needed pause in the whirlwind of activity in Washington, where politicians have been working on legislation that could devastate our desperately needed affordable housing programs.

Last week I went to Washington to personally warn Ohio’s Congressional delegation about the negative impact the tax bills could have on their most vulnerable constituents. Thanks to everyone who called our senators and representatives – Sen. Portman’s aide told us they received 50,000 calls! Keep them coming – they are having an impact!

Whether you like it or not, federal tax incentives for private investors are the only reason there’s any affordable housing still being produced and renovated in our country. Simply put – messing with the federal tax code puts those programs at risk.

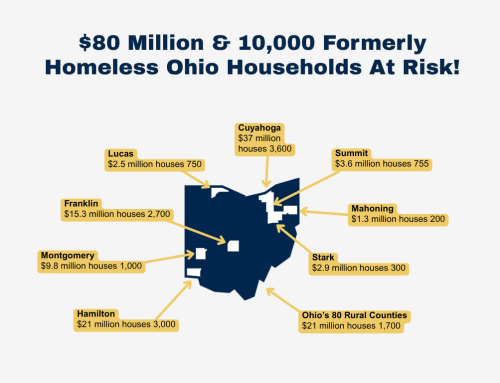

While both the House and Senate tax bills would preserve the Low Income Housing Tax Credit program, cutting the corporate tax rate will devalue the credits. Even more concerning, the House version would scrap private activity bonds, which are necessary to finance large multi-family affordable housing projects through the LIHTC program. To make matters worse, both bills eliminate historic tax credits, which are used to help fund preservation of affordable housing in Ohio. All told, these bills are expected to reduce affordable housing production and preservation in Ohio by up to 81,000 rental units over the next decade, according to a recent Novogradac & Co. analysis.

The House passed its version last week, and the Senate is hoping to pass its proposal in the first week of December in order to get a tax bill to President Trump by Christmas.

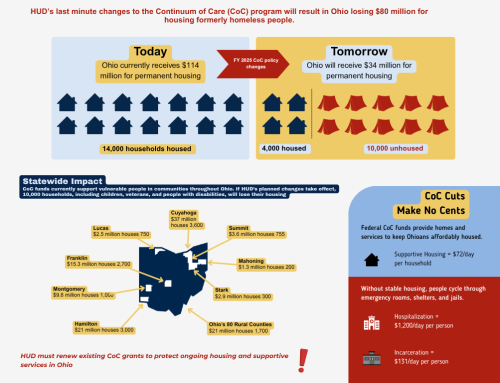

In the big picture, this legislation will primarily give a $1.5 trillion tax cut to wealthy corporations and individuals, which will soon explode the federal deficit. That will then force big cuts to entitlements and domestic discretionary spending, like HUD’s housing and homelessness programs.

We need to make sure the tax bill does no harm to our low-income housing tools, like LIHTC and historic tax credits because any new tax policies could be in effect for many years to come. But even if we succeed in protecting LIHTC and HTC, the tax bill presents a huge threat to future funding for programs that provide decent affordable housing for the most vulnerable Ohioans.

Just to complicate things, federal budget negotiations are continuing in the background of the tax cut negotiations. While the House and Senate versions are big improvements over Trump’s initial FY 2018 budget proposal, the current budget bill still needs an additional $345 million just to prevent the loss of 40,000 Housing Choice vouchers.

So have a peaceful and restorative Thanksgiving holiday. But next week please take action – call Sen. Portman’s office (202-224-3353) and express your concern about the tax bill’s impact to affordable housing programs and the federal deficit.

Bill Faith, Executive Director

For more information on what you can do to improve the tax bill, visit the A.C.T.I.O.N. Campaign’s website. The Campaign for Housing and Community Development Funding has more details on federal budget negotiations.