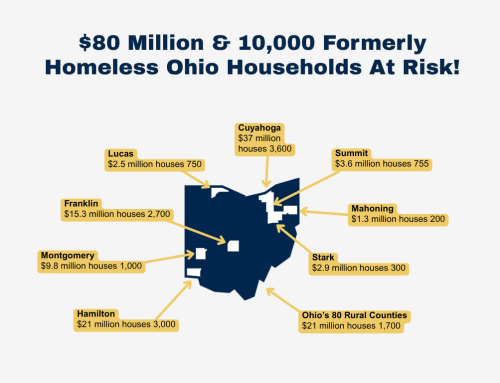

Please take a moment to add your organization to this letter of opposition to Senate Bill 36 in the Statehouse. In the midst of our growing affordable housing shortage, this legislation would significantly increase the costs of operating many tax credit and subsidized housing properties by taxing them the same as conventional market rate housing. This would have a devastating impact on Ohio’s assisted housing stock.

Passage of SB 36 would change the way property taxes are assessed on Low Income Housing Tax Credit properties and other types of federally subsidized housing. It would ignore the fact that operators cannot legally charge their residents market rate rents, instead taxing them for income that could be theoretically collected without any rent restrictions in place.

To be clear, this legislation puts existing affordable housing at risk AND makes it harder to develop new affordable housing, which makes our efforts to end homelessness even more difficult. Please stand with us in solidarity to protect affordable housing in the Buckeye State.

In addition to signing this letter, please take a few minutes to call your State Senator’s office and express your opposition to Senate Bill 36. There could be another hearing as soon as April 2, so please weigh in ASAP.

Don’t know who your State Senator is? Click here and enter in your address to find out.

Sincerely,

Bill Faith

Executive Director

More information on SB 36: